双语阅读|意大利政府债券与银行风险的“双簧”戏

Italy's budget loop 来自翻吧 00:00 05:09

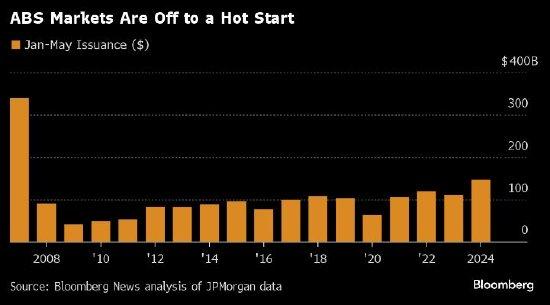

IN ITALY’S BUDGET drama, the action is shifting away from Rome. Last month its populist government said it would run a fiscal deficit of 2.4% of GDP in 2019—wider than euro-zone rules permit, and than markets had expected. Cue a sharp rise in borrowing costs, to more than three percentage points above those in Germany (see chart). On October 15th it submitted its plans to the European Commission. With Brussels likely to raise objections to the budget, this spread could rise further still.

意大利的预算闹剧的剧情正在远离罗马。在9月,意大利民粹主义政府称,到2019年,财政赤字将达到GDP的2.4%——比欧元区允许的范围大,也大过了市场预期。这预示着借款成本将大幅上升,比德国多出3个百分点以上(见图表)。10月15日,意大利政府向欧盟委员会提交了预算规划。由于欧盟可能会对预算提出异议,这一差距可能还会进一步扩大。

Fears about the sustainability of Italy’s huge public-debt burden have also infected its financial sector. Lenders’ share prices have fallen by 14% since the government unveiled its plans. Compared with Germany or Spain, a relatively low share of public debt—a third—is held by flighty foreigners. But that leaves the financial sector more exposed. So far banks’ improved liquidity and capital positions have cushioned the impact of sovereign-debt woes. But not all lenders are well-placed to cope with a further rise in bond yields.

对意大利巨额公共债务负担的可持续性的担忧也蔓延至意大利金融行业。意大利政府公布预算规划后,意大利银行的股价下跌了14%。相比与德国或西班牙,意大利的公共债务中只有一小部分——三分之一——是由反复无常的外国人持有的,不过,这却让金融业面临更大的敞口风险。到目前为止,意大利银行业流动性和资本状况得到了改善,缓解了主权债务危机的影响。不过,不是所有的贷款机构都能很好地应对债券收益率进一步上升局面。

Doom loops, where weak governments and banks drag each other down, featured in debt crises in Greece, Ireland, Spain and Portugal. Euro-zone rules have since restricted governments’ ability to bail out banks. Even so, channels connect the two. Banks have big holdings of sovereign debt. And lenders and sovereigns are linked through the economy. If banks deal with losses on sovereign exposures by lending less to companies or individuals, that weakens public finances, closing the loop.

在希腊、爱尔兰、西班牙和葡萄牙的债务危机中,最为典型的是运行低效的政府和银行相互拖累,形成恶性循环。欧元区法规一直以来都在限制政府救助银行。即便如此,仍然还有连接两者的渠道。银行持有大量主权债务。贷款机构和主权国家通过经济联系在一起。如果银行通过减少对企业或个人的贷款来应对主权风险敞口风险所带来的损失,就会消弱公共财政,从而结束这一恶性循环。

Italy’s banks have loaded up on public debt since 2011, in part because such debt is treated relatively favourably by regulators. Their holdings amount to around €390bn ($450bn), or a tenth of their assets, well above the euro-area average of 4%. (Other financial firms, such as pension funds and insurers, hold even more government debt; thanks to quantitative easing, the central bank owns a chunk, too.) Rising sovereign yields directly affect banks’ financial health by making funding more expensive, and losses harder to withstand.

自2011年以来,意大利的银行累积了大量公共债务,一个原因是监管机构对此类债务持相对友好态度。银行大约持有3900亿欧元(合4500亿美元)的总量,占资产总额的十分之一,远高于欧元区平均4%的水平。(其它金融机构,如养老基金和保险公司,持有政府债券更多;由于量化宽松政策,意大利央行也拥有一大笔资金的政府债券。)主权债券收益率的上升导致融资成本上升、亏损更难承受,直接影响银行的财务健康。

Tapping funding markets has already become more costly. Francesco Castelli of Banor Capital, an asset-management firm, notes that large banks were issuing four-year bonds at interest rates below 1% in May; rates have since crept up to nearly 2.5%. Smaller banks, he thinks, could face forbiddingly high rates. Fortunately, banks are “awash with liquidity”, says Guido Tabellini of Bocconi University. Their holdings of liquid assets, as a share of their short-term obligations, are above regulatory floors. And they have been heavy users of the European Central Bank’s targeted longer-term refinancing operations (TLTROs), which offer cheap funding.

利用融资市场的成本越来越高。资产管理公司Banor Capital的Francesco Castelli指出,一些大银行在5月以低于1%的利率发行了4年期债券;此后,利率攀升至近2.5%。他认为,小银行可能会面临高得令人生畏的利率。博科尼大学的Guido Tabellini说,幸运的是,银行“流动性充足”。作为短期债务的一部分,银行持有的流动资产高于监管层要求的最底限。他们一直是欧洲央行(ECB)有针对性的长期再融资操作(TLTROs)的主要用户,后者提供廉价融资。

But the pain of higher funding costs may merely have been deferred. Banks must begin repaying the €250bn they have borrowed through the ECB’s scheme from mid-2020. They may need to start refinancing earlier, says Mr Castelli: TLTRO funds will stop counting towards some regulatory measures of liquidity once their maturity falls below a year. If funding costs are still high when banks need to raise money, their profitability will be squeezed, unless they can pass the increase on to customers.

不过,更高的融资成本带来的痛苦可能一直在推迟到来。各家银行必须开始偿还的通过欧洲央行计划于2020年代中期到期的2500亿欧元贷款。卡斯泰利表示,银行可能需要更早地开始再融资:TLTRO基金一旦到期时间不足一年的情况下,就将不再指望某些流动性的监管措施。如果在银行需要融资时,融资成本仍然很高,它们的盈利能力就会受到挤压,除非它们能够将增长转嫁给客户。

Sustained rises in sovereign-debt yields (and thus falling bond prices) also mean that banks have to reprice their holdings of government debt. That will erode capital buffers—their ability to withstand future losses. Bank analysts reckon that increases in spreads seen so far have had small, manageable effects on banks’ capital ratios.

主权债务收益率持续上升(从而导致债券价格下跌)也意味着银行必须对所持有的政府债券重新定价。这将削弱资本缓冲——它们抵御未来损失的能力。银行业分析师估计,迄今为止,息差的增长对银行资本比率的影响很小,是可控的。

Further large rises in sovereign spreads, though, could spell trouble. Analysts from Credit Suisse, an investment bank, reckon that some banks would need fresh capital once spreads pass four percentage points. Mid-sized banks such as Monte dei Paschi di Siena, which has had a string of troubles, and UBI Banca and Banco BPM, look vulnerable. They are more exposed to public debt, and have lower capital ratios.

不过,主权债务息差进一步大幅上升可能会带来麻烦。投资银行瑞士信贷的分析师估计,一旦息差超过4个百分点,一些银行将需要新资本。中等规模的银行,如遭遇一连串麻烦的西耶那银行,以及UBI Banca和Banco BPM银行,则显得很脆弱。他们的公共债务风险更大,资本比率也更低。

The larger lenders, Intesa Sanpaolo and UniCredit, have done more to shore up profitability by cutting costs and selling non-performing loans. But much higher government borrowing costs would bring down the curtain on economic growth. Non-performing loans would start to rise again, threatening profits. No one is predicting a recession in Italy just yet. But the theatrics are not over.

意大利联合圣保罗银行和意大利联合信贷银行这两家规模较大的银行通过削减成本和出售不良贷款,在提高盈利能力方面做了更多的事。但是,更高昂的政府借贷成本将会拉下经济增长的帷幕。不良贷款将再次开始上升,威胁到利润。目前还没有人预测意大利会出现衰退。这些戏还没有结束。

编译:何坤、

编辑:翻吧君

来源:经济学人(2018.10.20)

阅读·经济学人

英国铁路系统再掀“国有化”声音

比特币“过山车式”价格波动 引发投机

美联储加息困境:利率和就业间的平衡点在何处?

高管薪酬高企加剧与贫富不均

英国财政大臣准备提高税收

韩国新经济政策难断财阀手足

科技巨头虎视眈眈下的健康产业

优化公共资产可弥补政府债务窟窿

翻吧·与你一起学翻译 微信号:translationtips

长按识别二维码关注翻吧

查看原文 >>