“原油—成品油/石腦油—化工品”誰是鏈上的老大?

來源:聚酯PTA乙二醇短纖投研根據地

Please note that the full English translation is at the end.

在研究石腦油套期保值和加工利潤套期保值的過程中,總結歸納了一些關於石腦油的問題。對於石腦油,從未實盤操作過,下面文字如有思慮不周之處,敬請批評指正。

摘要

成品油需求會影響石腦油的供應數量、成本水平、化工下游開工。

化工利潤(石腦油→化工品)受成品油利潤(原油→成品油)的影響很大;成品油利潤與化工利潤基本負相關。

成品油利潤(原油→成品油)與石腦油利潤(原油→石腦油)基本負相關。

石腦油的兩個特點

石腦油佔油品的份額小

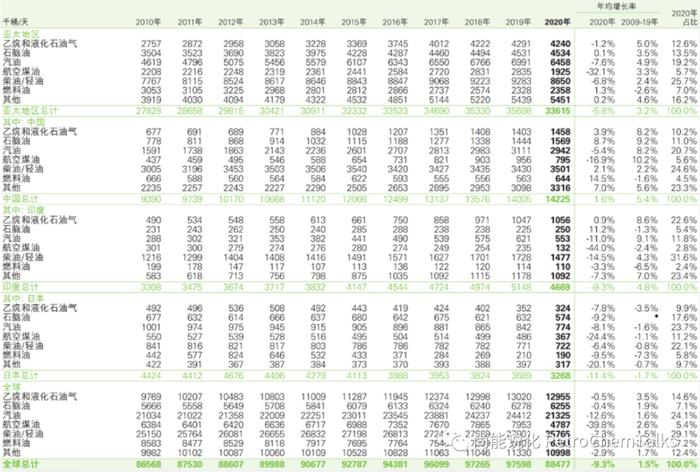

煉油的下游油品中,石腦油的份額小:中國11%,亞太13%,全球7%。而汽柴煤油的一般佔比在50%~60%左右。

![]()

石腦油既能裂解也能調油

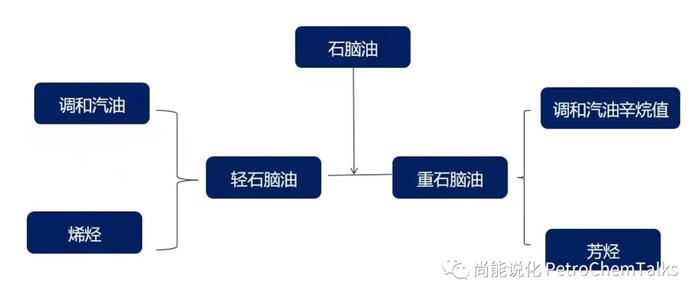

石腦油以及其他的一些烷烴和芳烴具有二元性特徵:不僅可以作爲裂解原料去生產烯烴等化工產品,也可以用於調油(包括煉廠和調油貿易商)去生產汽油等能源產品。

![]()

調製汽油的原料

直餾汽油(石腦油、石油醚),輕質石腦油,凝析油(輕烴),精製C5、C9、C10化工油,芳烴150#、200#,混合芳烴,甲醛脂,MTBE, DMC,高碳醇等。

調製柴油的原料

重柴油,蠟油,焦化蠟油,200#以上的溶劑油,重芳烴,C8、C9、C10、C11、C12、C13、C14、C15,航空煉油。燈用煤油,常線油,減一線油,200#、230#、270#芳烴溶劑油,3#礦物油,地煉柴油,裂解柴油,焦化柴油等。

正文

簡化起見,先不考慮原油和成品油的供給衝擊,只考慮成品油需求(利潤)波動造成的成品油價格和加工利潤的變化。

1、成品油利潤影響石腦油供應:成品油利潤對於石腦油供應的影響從兩方面展開:排產比例和煉廠總體開工率。

A. 排產比例

成品油利潤好,成品油排產比例上升,石腦油排產比例減少,石腦油和調油組分(芳烴類、高烷烴等)會較多地去成品油,都會減少石腦油的供應。

而且,因爲石腦油佔油品的份額低,所以排產和調油造成的成品油產出比例的小幅調整,比如1~2%,就將造成石腦油供應10~20%的波動。

因此,造成石腦油和其他化工單體原料供應端較大的波動,從而造成它們價格的大幅波動。

成品油通過排產比例影響石腦油的價格,成品油高利潤→成品油高排產比例→石腦油低排產比例→石腦油高價格,是正相關的關係。

【案例】在2022年5月第一個成品油利潤高峯時,石腦油和PTA的價格都達到了年內高位。

B. 煉廠總體開工率

成品油因爲佔油品的份額高,所以成品油利潤的高低又決定着煉廠的總體開工率。成品油利潤較好時,煉廠會提高開工率,同樣也會增加石腦油的供應。因此,石腦油和其他化工原料的供應增加會相對明顯,從而造成石腦油價格降低。

成品油通過煉廠開工負荷影響石腦油的價格,成品油高利潤→煉廠高開工率→石腦油高供應→石腦油低價格,又是負相關的關係。

【案例】2022年下半年開始,輕重石腦油價格的劈叉。煉廠的高開工造成輕重石腦油的產量增加,一方面重石腦油的調辛烷值功能和生產的芳烴有調油需求,重石腦油價格持續上漲;另一方面輕石腦油由於產量也同步增加,但是乙烯裂解裝置因爲經濟性原因需求不好,輕石腦油價格降低。

可以將A路徑理解爲競爭品關係,將B路徑理解爲副產品關係。至於哪種關係起主要作用,還是要看A和B哪一種路徑對石腦油供應造成更多的影響。

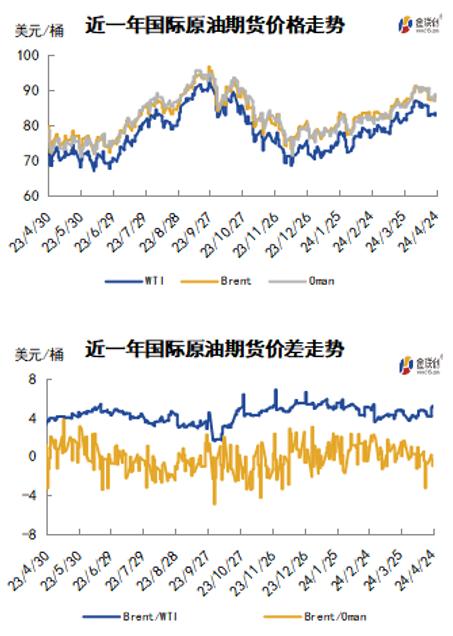

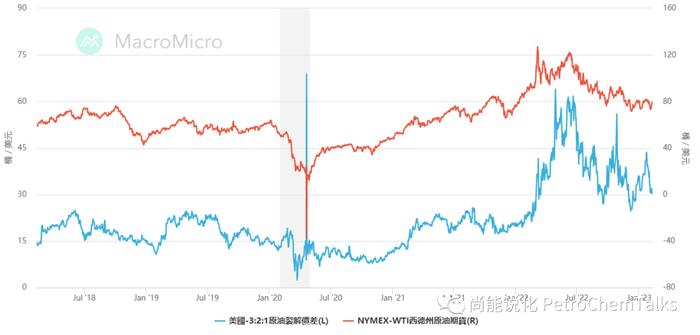

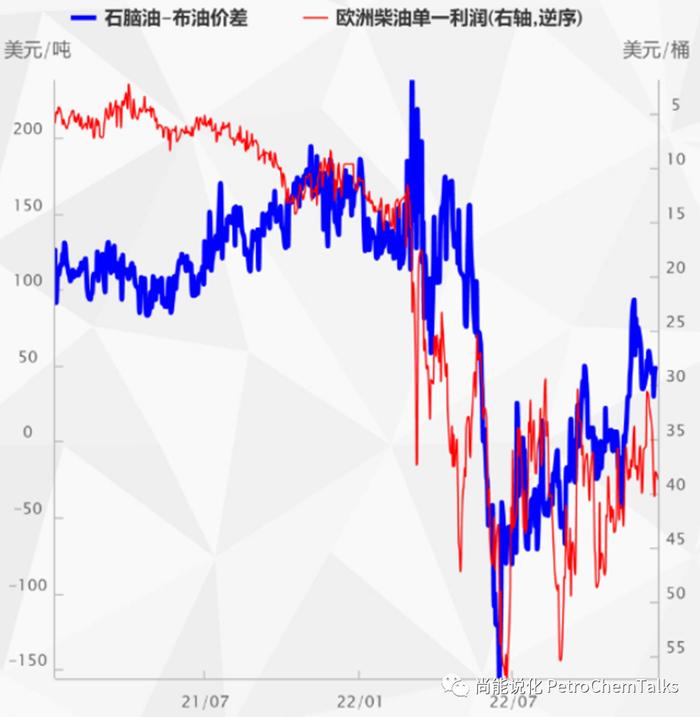

2、成品油利潤影響石腦油成本:成品油需求旺盛,利潤上升,價格上漲。成品油是原油最主要的下游,當成品油的需求和價格上升,也會導致原油價格上漲。成品油裂解價差(下圖紅線)與原油價格(下圖藍線)的關係如下,近一年的正相關關係更爲明顯。而由於成品油裂解價差導致的原油價格上漲同時也會推升石腦油等化工原料的價格。

成品油通過原油需求影響石腦油的價格,成品油高利潤→原油需求增加→原油高價格→石腦油高成本,是正相關的關係。

2018-至今

2022-至今

注:傳統裂解以3桶WTI原油煉製2桶汽油(RBOB)以及1桶加熱用燃油(HO)爲基準,傳統裂解“價差”=(RBOB 汽油的每桶價格*2+HO熱用燃油的每桶價格*1-WTI原油的每桶價格*3。熱用燃油可以視作柴油。

從煉油廠預期到實際購買及煉油會有1個月以上的時間差,因此裂解價差通常會領先油價。用油旺季:汽油或燃油庫存減少、價格上漲→裂解價差擴大,煉油廠增加原油需求,原油價格上漲。用油淡季:汽油或燃油庫存增加、價格下跌→裂解價差收斂,煉油廠減少原油需求,原油價格下跌。

3、成品油下游剛於石腦油下游:成品油需求旺盛,利潤上升,價格上漲,石腦油價格跟漲,但是下游對高價的承接能力不一樣。成品油對應的下游——能源、出行需求更爲剛性,價格承接力更強。石腦油和其他化工原料對應的下游——工業需求相對彈性較大,價格承接力較差。

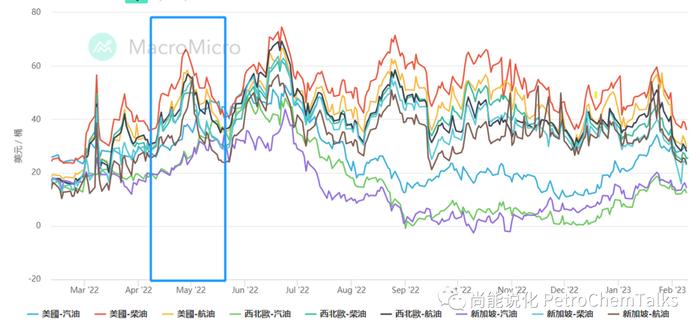

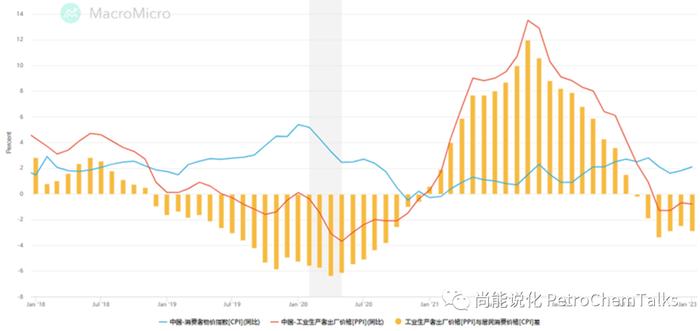

成品油價格波動對應的是CPI,石腦油價格、化工產品價格波動對應的是PPI。PPI(下圖紅線)相對CPI(下圖藍線)更爲波動,因爲PPI更多對應企業部門,CPI更多對應居民部門。企業利潤擴展或者虧損加劇,會更迅速地往上反饋到對生產原料的需求。同樣的,原料成本上升或者下降,也會更容易往下傳導到企業的盈虧波動。

因此,石腦油等化工原料的下游需求相對於成品油的下游需求,對價格更爲敏感,即原料價格上漲後如果導致總體生產運營虧損,企業更容易通過降低開工率去減少採購需求,從而對石腦油價格進行負反饋。

然而,因爲石腦油份佔油品的份額小,並且可以由化工轉爲去調油,所以這種負反饋往上傳導到煉廠可以“輕鬆”地被成品油吸納,對煉廠的總體開工負荷影響很小。因此,煉廠也不會因爲這種負反饋而去調整石腦油價格。相比之下,成品油佔油品的份額大得多,並且下游的能源、出行需求更爲剛性,所以負反饋的能力和價格承接的能力更強。

所以,我們推測:

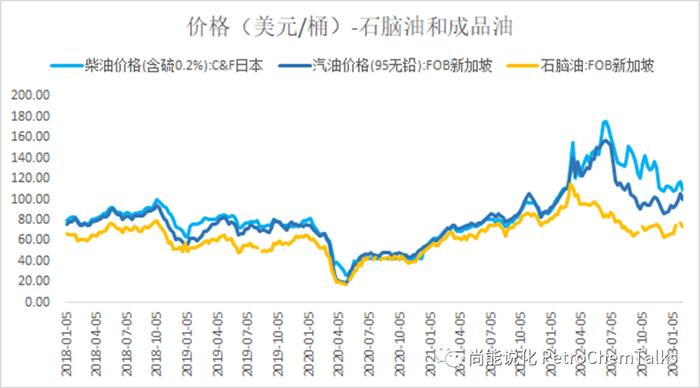

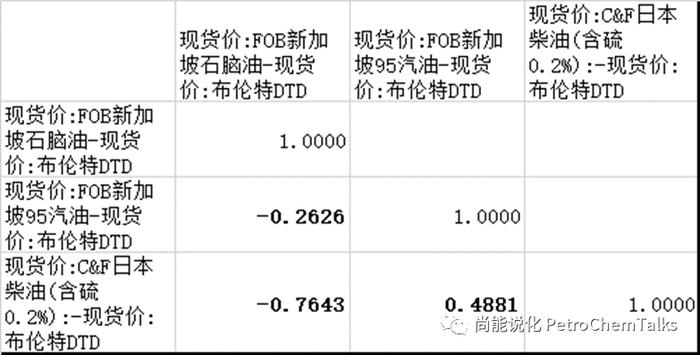

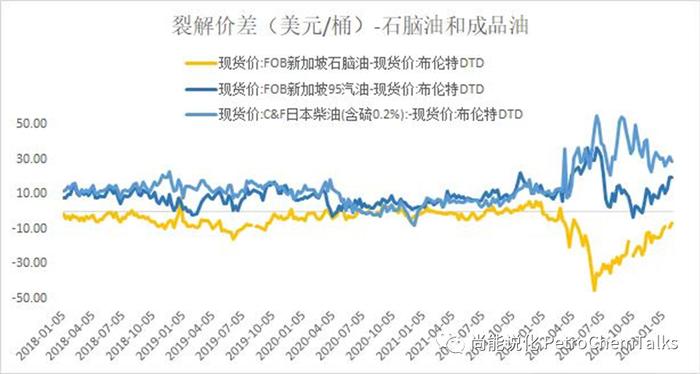

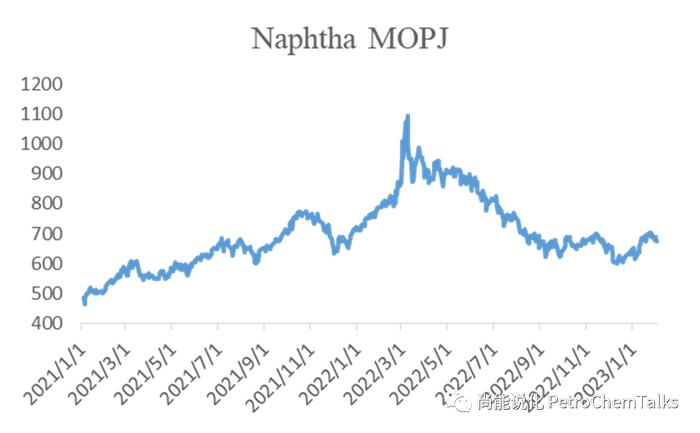

石腦油的價格波動遠小於成品油,尤其是石腦油的漲幅遠小於成品油。下圖的標準差均值比證明了我們的推測。

![]()

![]()

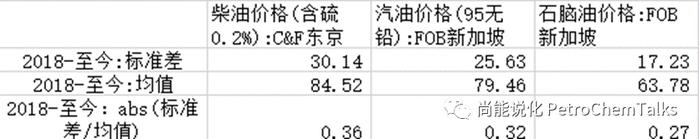

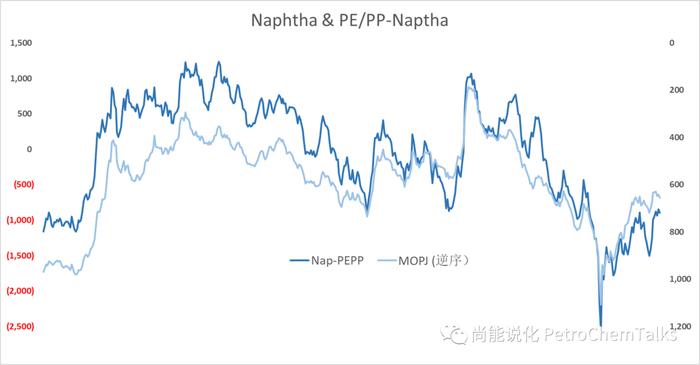

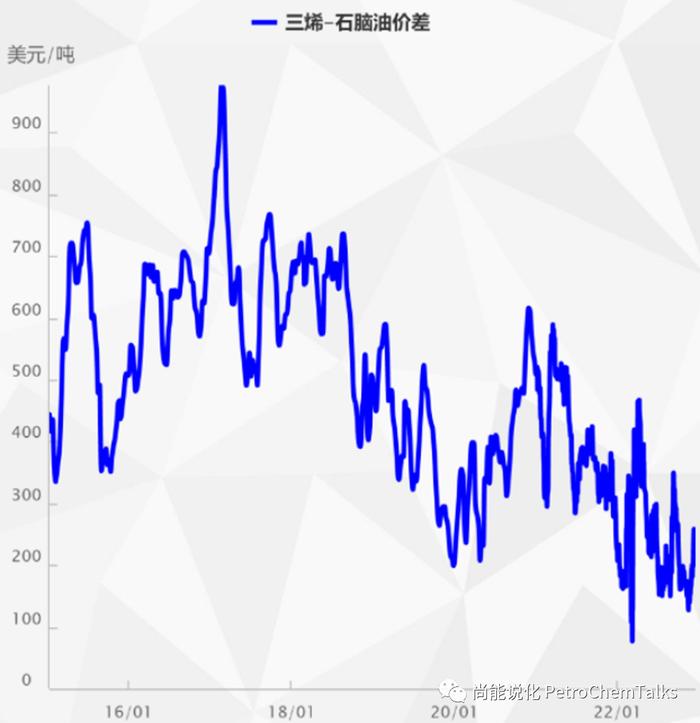

成品油下游對高價的承接力強於石腦油下游,因此成品油加工利潤可以較好保持,而化工利潤(即化工企業高生產利潤)較難保持。下圖的化工企業生產利潤(以聚烯烴-石腦油爲表徵)基本和石腦油價格高度負相關。

![]()

通過上面的論述,我們可以總結:

成品油需求影響石腦油供應:從排產比例和煉廠開工兩個方面一正一負地通過影響石腦油供應去作用到石腦油的價格。

成品油需求影響石腦油成本:成品油裂解利潤與油價正相關,與石腦油價格正相關。

成品油需求剛性大於石腦油:成品油價格波動更大,下游需求更爲剛性,價格承接力更強。相比之下,石腦油價格波動較小,下游需求彈性較大,價格承接力較弱。

結論

1、成品油利潤與化工利潤基本呈負相關

成品油利潤好、需求好、價格高,導致石腦油價格高,但下游化工品對高價承接力弱,化工利潤降低。

也有正相關的時候,比如在2022年三季度,成品油加工利潤和化工利潤同時下降,主要原因是市場大幅交易加息引起美國衰退和經濟硬着陸,以及能源通脹對歐洲產出和需求的壓制。

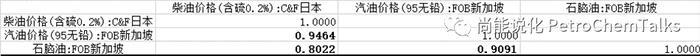

能化-SC近似代替化工利潤,因爲相對於高波動的原油價格而言,Nap裂解價差是相對穩定的變量,所以用SC代替Nap也合理。Nap=原油+裂解價差,Nap基本由原油的價格和波動決定。

2、成品油利潤與石腦油利潤基本呈負相關

化工下游化工產品首先進行負反饋,將阻止石腦油價格的上升,進而影響石腦油的加工利潤。

如果化工產品的PPI可以成功向下傳導到製品的CPI,負反饋會減少,石腦油價格會重拾升勢。

如果上游原油向下的成本傳導非常劇烈,比如原油因爲戰爭地緣等原因,價格持續上漲,石腦油價格也將被動抬升。

3、煉廠可以承受石腦油較大的加工利潤波動

作爲小份額副產品的石腦油,煉廠可以“忍受”負的加工利潤(類似高硫燃料油)。

2022年的市場表現

成品油需求漲、價格漲、加工利潤漲,石腦油價格高

⬇

化工下游基本面需求差,而石腦油價格高,化工原料成本高,化工利潤爲負

⬇

化工鏈條負反饋到石腦油,石腦油加工利潤與價格同跌

化工鏈條利潤並非只由成本端的石腦油決定,也會受化工品自身供需面影響。

首先,石腦油由於下游負反饋並沒有價格大漲,成品油加工利潤與石腦油的加工利潤以及化工產業利潤都呈現負相關。

其次,成品油利潤太好,煉廠火力全開,作爲“副產品”的石腦油產量也很高, 所以 A.石腦油的供應端相對來說還是較爲充分,B.石腦油的需求端化工產品的需求差造成化工品價格低,化工生產利潤下滑,化工企業開工降低,造成對石腦油的需求減少。

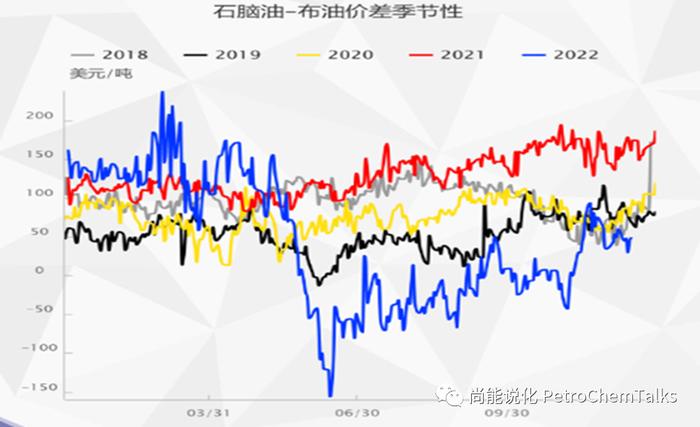

A和B都造成了石腦油價格下跌,石腦油的絕對價格在2022年跌到了較低位置,相對價格於布油的價差也在季節低位。

“原油—成品油/石腦油—化工品”誰是鏈上的老大?

在不考慮地緣衝突/原油供給衝擊的影響下,總量、價格、利潤、波動,還是成品油說了算。

In the process of studying naphtha hedging and processing profit hedging, some problems about naphtha are summarized. For naphtha, it has never been operated in real operation, and if the following text is not thoughtful, please criticize and correct.

Summary

Demand for refined oil products will affect the supply quantity of naphtha, cost level, and downstream start of chemical industry.

Chemical profits (naphtha → chemicals) are greatly affected by refined oil profits (crude oil → refined oil); The profit of refined oil is basically negatively correlated with the profit of chemical industry.

Refined oil profits (crude oil → refined products) are basically negatively correlated with naphtha profits (crude oil → naphtha).

Two characteristics of naphtha

Naphtha accounts for a small share of oil products

The share of naphtha in the downstream oil products of refining is small: 11% in China, 13% in Asia Pacific and 7% globally. The general proportion of gasoline diesel kerosene is about 50%~60%.

Naphtha can both crack and refine oil

Naphtha and some other alkanes and aromatics have binary characteristics: not only can it be used as a cracking raw material to produce chemical products such as olefins, but also for oil blending (including refineries and oil blending traders) to produce energy products such as gasoline.

Raw materials for preparing gasoline

Straight-run gasoline (naphtha, petroleum ether), light naphtha, condensate (light hydrocarbon), refined C5, C9, C10 chemical oil, aromatic hydrocarbon 150#, 200#, mixed aromatic hydrocarbon, formaldehyde lipid, MTBE, DMC, high carbon alcohol, etc.

Raw materials for preparing diesel

Heavy diesel, wax oil, coking wax oil, solvent oil above 200#, heavy aromatics, C8, C9, C10, C11, C12, C13, C14, C15, aviation refining. Kerosene for lamps, constant line oil, minus one line oil, 200#, 230#, 270# aromatic solvent oil, 3# mineral oil, ground refining diesel, pyrolysis diesel, coking diesel, etc.

Body

For the sake of simplification, the supply shock of crude oil and refined oil is not considered, and only the changes in refined oil prices and processing profits caused by fluctuations in refined oil demand (profit) are considered.

1. Refined oil profits affect naphtha supply: The impact of refined oil profits on naphtha supply starts from two aspects: the production ratio and the overall operating rate of refineries.

A. Scheduling ratio

The profit of refined oil is good, the proportion of refined oil production increases, the proportion of naphtha production is reduced, and naphtha and oil blending components (aromatics, high alkanes, etc.) will go to refined oil more, which will reduce the supply of naphtha.

Moreover, because naphtha's share of oil products is low, a small adjustment in the proportion of refined oil output caused by scheduling and oil adjustment, such as 1~2%, will cause a fluctuation of 10~20% in naphtha supply.

As a result, large fluctuations in the supply side of naphtha and other chemical monomer raw materials have occurred, resulting in large fluctuations in their prices.

The high profit of refined oil products→ the high scheduling ratio of refined oil→ the low scheduling ratio of naphtha→ the high price of naphtha, are positively correlated.

【Case】At the first peak of refined oil profit in May 2022, the prices of both naphtha and PTA reached the high level of the year.

B. Overall refinery operating rate

Because refined oil products account for a high share of oil products, the level of refined oil profits determines the overall operating rate of the refinery. When refined oil margins are better, refineries will increase operating rates, which will also increase the supply of naphtha. Therefore, the increase in the supply of naphtha and other chemical raw materials will be relatively obvious, resulting in a decrease in the price of naphtha.

Refined oil products affect the price of naphtha through refinery operating load, and the relationship between high profitability of refined oil products→ high operating rate of → high supply of naphtha → low price of naphtha.

【Case】Starting in the second half of 2022, the price of light and heavy naphtha will split. The high operation of the refinery has led to an increase in the production of light and heavy naphtha, on the one hand, the octane function of heavy naphtha and the aromatic hydrocarbons produced have oil diversion demand, and the price of heavy naphtha continues to rise; On the other hand, the production of light naphtha has also increased simultaneously, but the demand for ethylene crackers is not good due to economic reasons, and the price of light naphtha has decreased.

The A path can be understood as a competitor relationship, and the B path as a by-product relationship. As for which relationship plays a major role, it depends on which path A and B have more impact on naphtha supply.

2. Refined oil profits affect the cost of naphtha: the demand for refined oil products is strong, profits are rising, and prices are rising. Refined oil products are the most important downstream of crude oil, and when the demand and price of refined oil rise, it will also lead to higher crude oil prices. The relationship between the refined oil cracking spread (red line below) and crude oil prices (blue line below) is as follows, and the positive correlation in the past year is more obvious. The rise in crude oil prices due to the cracking spread of refined oil will also push up the price of chemical raw materials such as naphtha.

Refined oil products affect the price of naphtha through crude oil demand, and the high profit of refined oil → the increase in crude oil demand→ the high price of crude oil → the high cost of naphtha are positively correlated.

Note: Traditional cracking is based on 3 barrels of WTI crude oil refining 2 barrels of gasoline (RBOB) and 1 barrel of heating fuel oil (HO), and the traditional cracking "spread" = (price per barrel of RBOB gasoline * 2 + price per barrel of HO hot fuel * price per barrel of 1-WTI crude oil * 3. Hot fuel oil can be thought of as diesel.

There is a time lag of more than 1 month from the time the refinery expects to actually buy and refine, so the crack spread usually leads the oil price. Peak season: Gasoline or fuel oil inventories decrease, prices rise→ cracking spreads widen, refineries increase crude oil demand, and crude oil prices rise. Off-season: Gasoline or fuel oil inventories increase, prices fall→ cracking spreads converge, refineries reduce crude oil demand, and crude oil prices fall.

3. The downstream of refined oil products is just below the downstream of naphtha: the demand for refined oil is strong, profits are rising, prices are rising, and the price of naphtha is rising, but the downstream capacity to undertake high prices is not the same. The downstream - energy and travel demand corresponding to refined oil products is more rigid, and the price acceptance force is stronger. The downstream - industrial demand corresponding to naphtha and other chemical raw materials is relatively elastic, and the price acceptance is poor.

The price fluctuation of refined oil corresponds to CPI, and the price fluctuation of naphtha and chemical products corresponds to PPI. PPI (red line below) is more volatile than CPI (blue line below) because PPI corresponds more to the corporate sector and CPI more to the residential sector. The expansion of corporate profits or the aggravation of losses will more quickly feed back upwards to the demand for production raw materials. Similarly, rising or falling raw material costs will be more easily transmitted downward to the company's profit and loss fluctuations.

Therefore, the downstream demand for chemical raw materials such as naphtha is more sensitive to price than the downstream demand for refined oil, that is, if the price of raw materials rises and leads to overall production and operation losses, it is easier for enterprises to reduce procurement demand by reducing the operating rate, thereby giving negative feedback to the price of naphtha.

However, because naphtha accounts for a small share of oil products, and can be converted from chemical to de-blending, this negative feedback can be transmitted upward to the refinery and can be "easily" absorbed by refined oil, with little impact on the overall operating load of the refinery. Therefore, refiners will not adjust naphtha prices because of this negative feedback. In contrast, refined oil accounts for a much larger share of oil products, and downstream energy and travel demand is more rigid, so the ability to negatively feedback and the ability to undertake prices are stronger.

So, we speculate:

The price volatility of naphtha is much smaller than that of refined oil, and the increase in naphtha in particular is much smaller than that of refined oil. The mean ratio of standard deviations in the figure below proves our conjecture.

The downstream of refined oil products has a stronger bearing force for high prices than the downstream of naphtha, so the profit of refined oil processing can be better maintained, while the profit of chemical products (that is, the high production profit of chemical enterprises) is more difficult to maintain. The production profits of chemical companies in the figure below (characterized by polyolefin-naphtha) are basically highly negatively correlated with naphtha prices.

From the above discussion, we can summarize:

Refined oil demand affects naphtha supply: from the two aspects of scheduling ratio and refinery operation, it affects the price of naphtha.

Refined oil demand affects naphtha costs: refined oil cracking profits are positively correlated with oil prices and positively correlated with naphtha prices.

The demand for refined oil is more rigid than naphtha: the price of refined oil fluctuates greater, the downstream demand is more rigid, and the price acceptance is stronger. In contrast, the price of naphtha is less volatile, the downstream demand elasticity is large, and the price carrying force is weak.

Conclusion

1. The profit of refined oil and the profit of chemical industry are basically negatively correlated

The profit of refined oil products is good, the demand is good, and the price is high, resulting in high naphtha prices, but the downstream chemicals have a weak ability to undertake high prices, and chemical profits are reduced.

There are also positive correlation times, such as in the third quarter of 2022, when refined oil processing profits and chemical profits fell at the same time, mainly due to the recession and economic hard landing in the United States caused by sharp market trading rate hikes, as well as the suppression of European output and demand by energy inflation.

Energical-SC approximates the replacement of chemical profits, because the Napp cracking spread is a relatively stable variable relative to highly volatile crude oil prices, so it is reasonable to replace Nap with SC. NAP = crude oil + cracking spread, Nap is basically determined by the price and volatility of crude oil.

2. The profit of refined oil and the profit of naphtha are basically negatively correlated

The first negative feedback of chemical downstream chemical products will prevent the rise in the price of naphtha, which in turn will affect the processing profit of naphtha.

If the PPI of chemical products can be successfully transmitted down to the CPI of products, the negative feedback will be reduced and the price of naphtha will resume its upward trend.

If the downstream cost transmission of crude oil is very violent, such as the price of crude oil due to war geography, etc., the price of naphtha will also rise passively.

3. The refinery can withstand large fluctuations in the processing profit of naphtha

As a small share of naphtha, a byproduct, refiners can "endure" negative processing margins (similar to high-sulfur fuel oil).

Market performance in 2022

Demand for refined oil products has risen, prices have risen, processing profits have risen, and naphtha prices are high

⬇

The fundamental demand for chemical downstream is poor, while the price of naphtha is high, the cost of chemical raw materials is high, and the chemical profit is negative

⬇

The chemical chain negatively fed back to naphtha, and the profit of naphtha processing fell with the price

The profit of the chemical chain is not only determined by the cost of naphtha, but also by the supply and demand side of the chemical itself.

First of all, the price of naphtha did not rise sharply due to negative feedback downstream, and the processing profit of refined oil was negatively correlated with the processing profit of naphtha and the profit of the chemical industry.

Secondly, the profit of refined oil is too good, the refinery is full of firepower, and the production of naphtha as a "by-product" is also very high, so A. the supply side of naphtha is relatively sufficient, B. the demand for naphtha demand side of chemical products is poor, the price of chemical products is low, chemical production profits are declining, chemical enterprises are operating down, resulting in a decrease in demand for naphtha.

Both A and B contributed to the decline in naphtha prices, with the absolute price of naphtha falling to a lower level in 2022, and the relative price spread to cloth oil also at a seasonal low.

"Crude oil - refined oil / naphtha-chemicals" Who is the boss in the chain?

Without considering the impact of geopolitical conflicts/crude oil supply shocks, the total volume, price, profit, and fluctuation are affected by the refined oil.