健全普惠性現代金融體系大有可爲(附英文版)

中央金融工作會議明確要做好包括普惠金融在內的“五篇大文章”。隨着經濟社會的發展,單一的存貸款服務已無法滿足居民多元化財富管理需求,通過健全普惠性現代金融體系,解決我國經濟社會發展中的短板弱項,是實現共同富裕的必然要求。

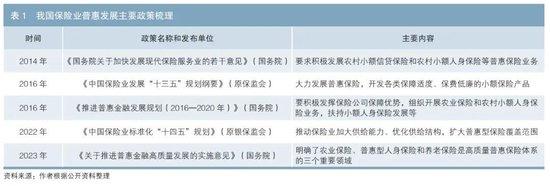

黨的十八大以來,我國普惠金融取得積極成效。我國已基本建成綜合性普惠金融體系,金融服務覆蓋面逐步擴大。一是基礎金融服務在縣域和農村地區發展迅速。全國已基本實現鄉鄉有機構、村村有服務、家家有賬戶,涉農貸款、小微企業貸款餘額保持高增速。二是多層次普惠保險體系進一步完善。在承保端,保險公司不斷推出惠民保、普惠型家財險等創新產品,完善社會保障體系;在投資端,保險資管推出紓困產品等,爲小微企業提供資金支持。三是普惠理財產品服務體系探索構建。截至2023年末,銀行理財產品的投資者達1.14億人,全年累計爲投資者創造收益6981億元。四是多層次債券市場功能不斷髮揮。支持銀行發行小微、“三農”等專項金融債,拓寬普惠信貸資金來源;櫃檯債券市場滿足居民多樣化投資需求,截至2023年末已服務超3178萬投資者,託管債券規模達7838億元。

新形勢下,普惠金融發展面臨新要求。中央金融工作會議明確要做好普惠金融大文章。國務院《關於推進普惠金融高質量發展的實施意見》對健全普惠組織體系、提升普惠金融效能給出實施路徑。目前,我國普惠金融體系建設仍存在較大提升空間。普惠屬性決定了相關服務具有客戶數量龐大、單筆業務規模小、獲客成本高的特點,如何平衡普惠金融產品準公益性和盈利性,如何有效保護金融消費者權益,成爲發展中的難點和痛點。同時,還存在中小金融機構內控機制薄弱、普惠金融產品可持續發展動能不足、部分資管產品信息披露不充分、市場波動時期易發生“贖回潮”等問題。這些都說明普惠金融既大有可爲,也需盡力而爲。

要充分發揮金融基礎設施的作用,促進普惠金融服務效能提升。金融基礎設施作爲金融市場的管道和樞紐,天生爲市場的安全、效率保駕護航。中央結算公司爲櫃檯債券投資者提供賬務複覈查詢服務,提供第三方透明性監督。理財中心建設中央數據交換平臺,支持理財業態高效、低成本的信息交互,持續建設完善行業統一信息披露渠道。中國銀保信面向保險投資者提供保單一站式查詢。

要加快數字化轉型,推動普惠金融與金融科技深度融合。新興科技的發展爲健全普惠金融體系帶來前所未有的機遇。利用大數據、人工智能等技術,可實現金融服務智能化、自動化和個性化,有效降低因普惠金融業務分散、小額、多樣而帶來的運營成本,提高服務效率。推動金融數字化轉型有利於普惠金融整合行業數據、加強數據治理,便利普惠服務聯動合作,也可爲建立風險監測、防範和處置機制及健全數字普惠金融監管體系提供堅實保障。

展望未來,在加強政策引導和治理協同的前提下,擁抱金融科技,健壯金融基礎設施,着力建設成本可負擔、商業可持續的多層次普惠金融體系,使普惠金融在服務中小微企業、提升居民收入水平、助力鄉村振興等國家戰略實施中發揮更大作用。

◇ 本文原載《債券》2024年3月刊

◇ 作者:鍾言

◇ 編輯:劉思敏 劉穎

A Promising Future for Improving the Inclusive Financial System

Zhong Yan

The Central Financial Work Conference has clearly stated the need to do well in five major sectors, including inclusive finance. With the development of the economy and society, the simple deposit and loan service can no longer meet the diversified wealth management needs of residents. To achieve common prosperity, it is necessary to improve the inclusive modern financial system and address the shortcomings and weaknesses in China’s economic and social development.

Since the 18th CPC National Congress, inclusive finance has achieved positive results. China has basically established a comprehensive inclusive financial system, and the coverage of financial services has gradually expanded. First, basic financial services have developed rapidly in counties and rural areas. China has basically achieved the goal of having institutions in every township, services in every village, and accounts in every household. The amount of agricultural loans and loans for small and micro enterprises has maintained a high growth rate. Second, the multi-level inclusive insurance system has been improved. On the underwriting side, insurance companies have launched innovative products such as welfare insurance and inclusive family property insurance to improve the social security system. On the investment side, insurance asset managers launched bail-out products to provide financial support for small and micro enterprises. The third is to explore and construct the service system of inclusive wealth management products. By the end of 2023, the number of investors in bank wealth management products reached 114 million, and the accumulated income for investors in the whole year was RMB698.1 billion. Fourth, the functions of the multi-level bond market continue to play their due roles. Banks have been supported special financial bonds for small and micro businesses and “sannong” (agriculture, rural areas and farmers), so as to expand sources of inclusive credit funding. The commercial bank counter bond market meets the diversified investment needs of residents. By the end of 2023, it had served over 31.78 million investors, and the outstanding bonds under depository had reached RMB783.8 billion.

Under the new situation, the development of inclusive finance faces new requirements. The Central Financial Work Conference has clearly stated the need to focus on promoting inclusive finance. The Implementation Opinions of the State Council on Promoting the High-Quality Development of Inclusive Finance provides an implementation path for improving the inclusive organizational system and enhancing the efficiency of inclusive finance. At present, there is still significant room for improvement in the construction of China’s inclusive financial system. To be inclusive, the financial service has to serve a large number of customers with a small scale of a single business coupled with high costs to get new customers. Therefore, the balance between the quasi public welfare and profitability, and the protection of financial consumer rights have become challenges in the development of inclusive financial products and services. At the same time, difficulties may also be caused by weak internal control mechanisms of small and medium-sized financial institutions, insufficient sustainable development momentum of inclusive financial products, insufficient information disclosure of some asset management products, and the risk of concentrated redemption during market fluctuations. All of these implies the significant room, as well as the urgent need of efforts, for the development of inclusive finance.

It is necessary to leverage the role of financial infrastructure and raise the efficiency of inclusive financial services. Financial infrastructure, as the pipeline and hub of the financial market, is inherently a safeguard for market security and efficiency. CCDC provides accounting review and inquiry services for bank counter bond investors, and provides third-party transparency supervision. China Wealth Management Registry & Custody Co., Ltd. has developed a central data exchange platform to support efficient and low-cost information exchange in the wealth management industry, and kept improving the unified information disclosure channel for the industry. China Banking and Insurance Information Technology Management Co., Ltd. provides one-stop policy inquiry for insurance investors.

It is recommended to accelerate digital transformation and promote the deep integration of inclusive finance and fintech. The development of emerging technologies has brought unprecedented opportunities for a sound inclusive financial system. By utilizing technologies such as big data and artificial intelligence, financial services can be intelligent, automated, and personalized, effectively reducing operational costs caused by dispersed, small-scale, and diverse inclusive financial services, and improving service efficiency. Promoting the digital transformation of finance is conducive to the integration of industry data, data governance, and cooperation of inclusive services. Also, it can provide solid support for establishing risk monitoring, prevention and disposal mechanisms and improving the regulatory system of digital inclusive finance.

Looking ahead to the future, while enhancing policy guidance and governance coordination, efforts can be made to embrace fintech, strengthen financial infrastructure, and focus on building a multi-level inclusive financial system that is affordable and commercially sustainable. This will enable inclusive finance to play a greater role in serving small and medium-sized enterprises, improving household income levels, and supporting national strategies such as rural revitalization.

This article was first published on Bond Monthly (Mar.2024). Please indicate the source clearly when citing this article. The English version is for reference only, and the original Chinese version shall prevail in case of any inconsistency.

◇ Editors: Liu Simin, Liu Ying